The first half of 2023 presented a number of challenges to the U.S. economy. Aggressive interest rate increases, stubborn inflation, tighter lending standards and general uncertainty have weighed heavily on economic growth.

Mercifully, neither recent bank failures nor a potential debt ceiling standoff exacerbated the situation.

Although headwinds are expected to persist over the coming quarters, the labor market and consumer spending remain strong. This could, ultimately, help the economy to avoid recession.

Looking at the construction sector, nonresidential starts are expected to maintain momentum in 2023’s second half, driven by largescale infrastructure investments and manufacturing-related construction projects.

According to Dodge Construction Network’s Mid-Year 2023 Construction Outlook, nonbuilding/infrastructure construction will increase 17% in 2023 to $295 billion as both sides of the market make gains. Public works will grow 18% to $232 billion, and power/utilities will expand 15% to $62.8 billion.

“Private manufacturing construction soared 8.7% from $173.84 billion in March to a record $188.96 billion in April,” said Chad Moutray, the National Association of Manufacturers (NAM) chief economist. “Private construction in the sector has trended significantly higher since bottoming out at $72.46 billion in February 2021. Over the past 12 months, activity has risen by a whopping 104.6%. This data speaks to the very sizable investments being made in the manufacturing sector, with firms strongly expanding their capacity to meet their long-term objectives. This should bode well for future growth in manufacturing in the U.S. moving forward.”

Investment in U.S.-based manufacturing facilities continues to be largely driven by legislation. The CHIPS Act supports an increase in the number of semiconductor plants within the United States while the Inflation Reduction Act of 2022 provides funding to improve supply chains and bolster new investment in domestic manufacturing. Given this legislation, manufacturing construction starts are expected to remain well above historic norms this year.

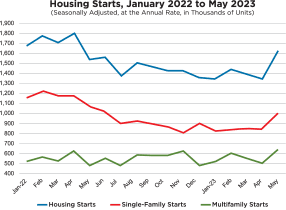

A shift already may be starting in the residential markets. In May, U.S. housing starts surged more than at any time since 2016, and building permits increased, suggesting residential construction is on track to help drive economic growth.

According to NAM, new residential construction activity soared 21.7% to 1.6 million units at the annual rate in May, a 13-month high. Single-family housing starts jumped 18.5% to 997,000 units, a reading not seen since June 2022, and multifamily housing activity rose 27.1% to 634,000 units, a 14-month high.

Overall, new housing starts have increased 5.7% since May 2022. The reading suggests the housing market is stabilizing after a loss of momentum that started early last year, prompted by elevated mortgage rates, high prices and tighter lending.

Despite economic challenges, contractors continue to add jobs at a healthy pace. However, lack of workforce continues to push wages up and, ultimately, force construction costs higher. Higher material costs and availability will remain a drag on the sector.

Although there is marginal growth at the macro level, this reflects substantial ups and downs in individual sectors. Precast concrete manufacturers that can shift production to growth segments will better manage through this period of economic uncertainty.

Each quarter, NPCA Vice President of Marketing and Communications Tom Rodak takes a look at where the precast concrete industry is and where indicators show it is headed.