The Build America, Buy America (BABA) Act was signed into law as part of the Infrastructure Investment and Jobs Act (IIJA) in November 2021. BABA requires the head of each covered federal agency to ensure that “none of the funds made available for a Federal financial assistance program for infrastructure, including each deficient program, may be obligated for a project unless all of the iron, steel, manufactured products, and construction materials used in the project are produced in the United States.”

BABA has a direct influence on the manufactured precast concrete industry, which supplies critical infrastructure structures across the United States. NPCA members need to understand the different product classifications, potential impacts and risks to compliance, the waiver process and how BABA compliments the Buy American (BA) Act to stay compliant and competitive.

This is the second of a four-part series outlining BABA and what it means to precasters. This article covers steps to complete this assessment and several typical breakdowns.

***

As a manufactured product, precast concrete must meet the 55% cost of components test to determine applicability of the BABA preference. Components are defined as an article, material or supply, whether manufactured or unmanufactured, incorporated directly into either:

- A manufactured product.

- An iron or steel product.

- Precast concrete components are inclusive of any excluded materials as defined in 70917(c) of BABA, because precast concrete is considered as a manufactured product and not as construction materials. See Part 1 for more on this.

Before performing the cost of components calculation for a manufactured product there are several things to note:

The cost of transportation and any applicable duty is included in the cost of the component.

For components manufactured by the manufacturer, profit is excluded from the cost of that component, but allocable overhead cost is included in the cost of the component.

If the cost of iron or steel in a product is more that 50% of the total cost of the product, it is considered predominately iron or steel and assessed under the iron or steel product category in which all manufacturing processes must occur in the United States.

To complete the cost of components calculations to determine if a specific product meets the BABA preference requirements:

Determine the cost of each component in a product.

Add all component costs to get the total cost of the product.

Add the cost of the components that were mined, produced or manufactured in the United States.

Divide the cost of components that were mined, produced or manufactured in the United States by the total cost of the product.

If the answer is greater than 0.55 (or 55%), the product meets the requirements of BABA, assuming the cost of steel or iron is less than 50% of the total product cost.

Example cost of components determinations

The following is an example of the cost of components calculations for wet cast, dry cast and SCC. It is understood that prices and incorporated transportation costs will vary from the assumed costs below by region and manufacturer.

However, this example will provide a general understanding of the major components influencing BABA preference compliance.

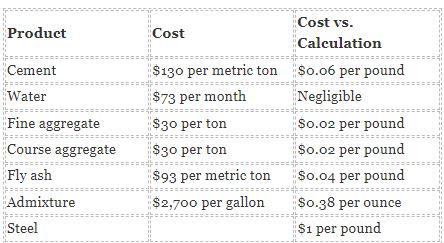

Cost assumptions

Other production costs, including rebar chairs, ties, etc., are considered negligible to the cost of the overall product.

Here is an example of a mix design for different types of precast concrete. Each example produces 1 cubic yard of concrete.

In these examples, steel ranges from 43% to 53% of the total cost of components. For the wet cast concrete example, cement is the second-most impactful component at 15% followed by coarse aggregate at 13%, admixture at 12% and fine aggregate at 9%.

Therefore, if the steel and any one of the other mentioned components is domestically produced, this example would meet BABA requirements.

For SCC, the second-most influential component is the admixture at 21%, followed by cement at 18% and then both fine and coarse aggregate at 9%. To meet BABA requirements in this example, the steel and either the admixture, cement or both aggregates must be domestically produced.

The dry cast example has steel at 53% of the total cost of components, which would then be assessed as a predominately steel or iron product and not as a manufactured good. In this case, all the steel must be domestically produced from initial melting through the application of any coatings to meet BABA requirements, the rest of the components are not considered.

This analysis was completed with assumptions for design and cost of components. NPCA recommends that an analysis be completed by producers for their products with actual component costs before certifying that their products are BABA compliant. These processes should be repeated as prices change asynchronously or as the mix design changes.

For more information on this topic, NPCA members can call (800) 366-7731.