Economic signals in the fourth quarter of 2025 continue to point to a mature stage of the cycle for construction investment. Recession risks remain elevated into 2026, even though many job sites are busy. Consumer prices are up about 3% from a year ago, and total annualized monthly U.S. construction spending has been trending higher since the spring, at roughly $2.17 trillion through August.

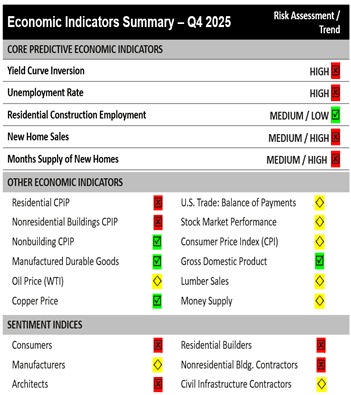

The economic indicators’ summary table that appears with this article shows four of five core predictive measures in warning or high-risk territory, led by a recently un-inverted yield curve (where long-term interest rates recently crossed above short-term rates) and a rising unemployment rate at 4.4%.

The federal government has reopened after a long shutdown, and key third-quarter data is arriving late, which complicates planning for 2026. The Federal Reserve delivered three interest rate cuts of 25 basis points in 2025, including a December 10 move that lowered the target range again, and it ended quantitative tightening as of December 1. These steps have started to ease borrowing costs and some credit spreads, but have not fully reversed the tightened policy conditions of the past two years

Headline construction investment hides different stories across sectors. Residential construction remains the weak spot, with housing starts near a 1.31 million annual rate and builder surveys still cautious. At the same time, October nonresidential construction starts jumped more than 20% as a wave of large data center and manufacturing projects moved from planning into active site work, mostly in the South and Midwest. Traditional office and retail work, multifamily and parts of the warehouse market continue to pull back under tighter credit and higher vacancies, while public works and infrastructure help provide a floor for precast demand, consistent with our October outlook.

Trends we are watching closely:

- Residential markets are soft but still functioning, with new home sales in a normal historical range and months’ supply of new homes closer to balanced market conditions than at any point in the past two years. For precast producers, this points to a thinner and more selective flow of residential work, with more activity in attached product types, build-to-rent communities and infill projects where buyers and renters can still qualify under stricter financing standards.

- Nonresidential construction faces slow overall growth, but segments tied to technology, industrial policy and public investment remain firm. Federal infrastructure and industrial programs continue to support transportation, water and utility projects, and regional data show the South capturing a large share of manufacturing and logistics spending, which rewards producers that align plant locations and field services with these long-duration programs.

- Megaprojects are now a defining feature of the industry’s outlook and help explain why schedules remain challenging even when funding appears secure. According to the fourth quarter 2025 ConstructConnect Forecast, projects valued at $1 billion or more totaled about $44 billion in starts in the third quarter 2025, up from about $31 billion a year earlier, with manufacturing starts up more than 70% year over year. These projects are complex, multi-phase efforts that place heavy demands on local infrastructure and specialized trades. Labor conditions add another pressure point, with roughly 30% of U.S. construction workers being foreign-born. Also, the latest October Bureau of Labor Statistics JOLTS data show construction job openings slightly more than 200,000, or only 3% of total U.S. job openings. Taken together, labor conditions signal a cooling market that remains tight for many skilled workers.

The practical message is disciplined caution with selective offense, close attention to customer credit quality and sector mix and a deliberate effort to align plant capacity, logistics and field crews with the most durable streams of work in infrastructure such as power, manufacturing and data centers. For precast stakeholders, that means being cautious about new ventures, monitoring customer financial strength and being highly strategic and selective in where to pursue work and commit investment and resources.

Brian Strawberry, a chief economist in the construction industry, leads FMI’s efforts in market sizing, forecasting, building products and construction material pricing, and consumption trends. He focuses on primary research methods, including the implementation and analysis of surveys and interviews. Brian also leads and manages various external market research engagements, and constructs tools and models for efficiently performing high-quality analyses.